Your Options Before and After a Missed Mortgage Payment

Clear guidance for homeowners making strategic decisions before consequences escalate — whether you're anticipating a shortfall or have just missed a payment.

Early action preserves credit, equity, and control.

Mortgage Payments Are Tight — What to Review First

Before missing a payment, review your monthly cash flow, equity, and loan terms. Understanding your position early preserves flexibility and leverage. Small, informed decisions today prevent larger financial consequences tomorrow.

When payments start to feel uncomfortable, most people delay action and hope conditions improve. That delay is often what eliminates the best options.

Key insight: Hardship does not eliminate options — inaction does.

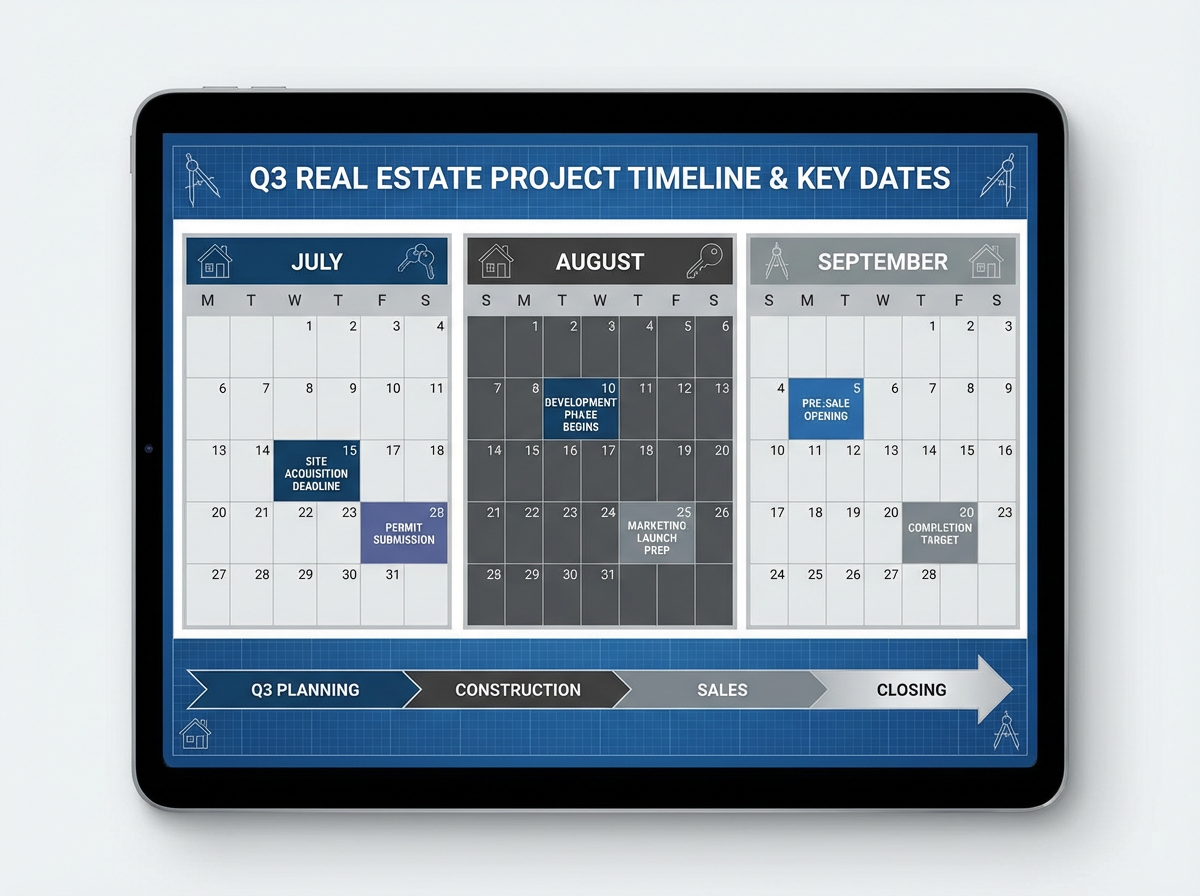

What Happens After a Missed Mortgage Payment

Missing a payment triggers a timeline of escalating fees, lender communications, and potential credit impact. Knowing these stages allows homeowners to make decisions strategically — stabilize, restructure, or exit — while options are still available.

This phase is still recoverable if handled strategically. Control comes from clarity.

Understanding Loan Modifications — How They Work and How to Qualify

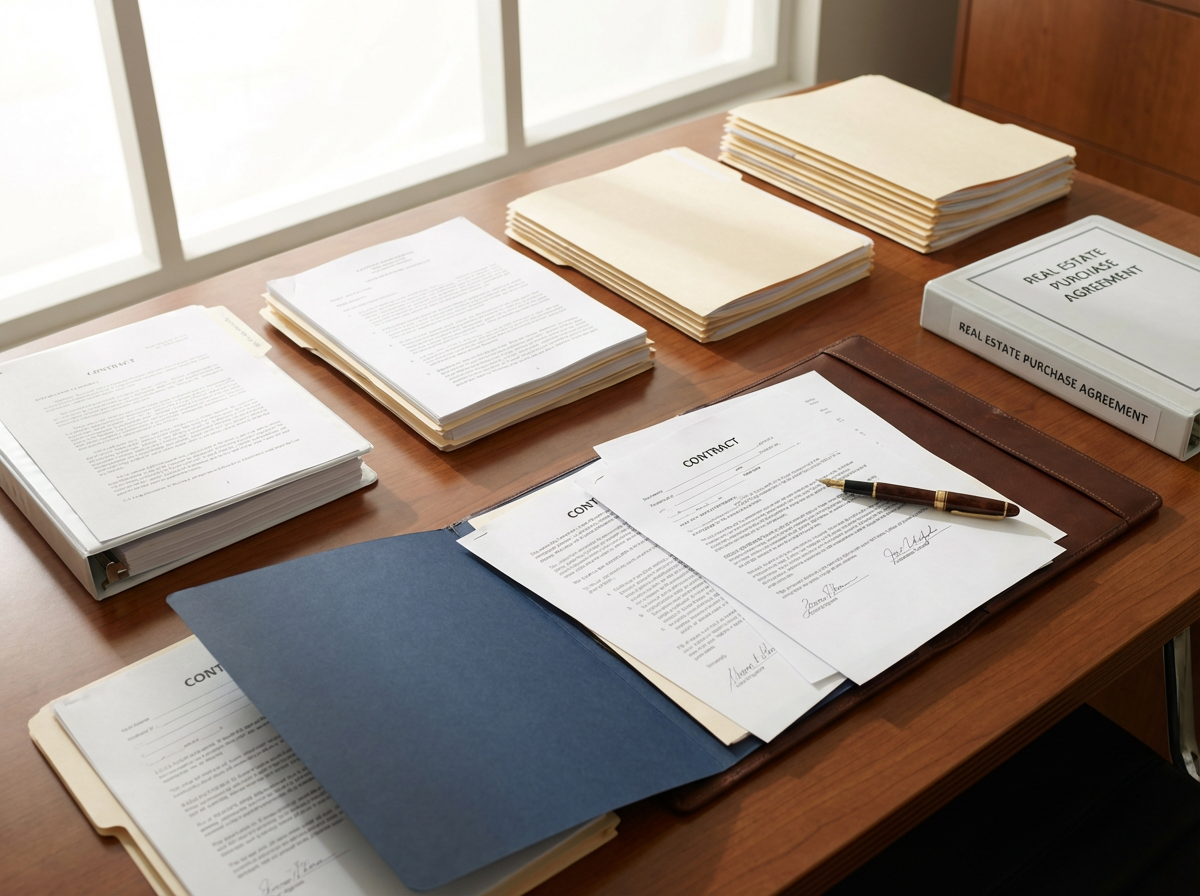

A loan modification is a formal adjustment to your mortgage designed to make payments more manageable. Lenders may lower interest rates, extend the loan term, or, in some cases, reduce principal.

Basic Requirements Banks Look For:

- Proof of financial hardship — Job loss, reduced income, unexpected expenses

- Current payment status — Usually behind but not excessively late

- Ability to pay modified terms — Demonstrating the new payment is realistic

- Documentation — Pay stubs, tax returns, bank statements, and a hardship letter

We provide a free written guide showing exactly how to prepare a complete loan modification package. Our team can assist you through each step to maximize approval chances while keeping you in control.

Call Cliff for Free Loan Modification GuideHow the No Dual Tracking Law Protects Homeowners

The No Dual Tracking Law prevents lenders from continuing foreclosure proceedings while your loss mitigation application is being reviewed. This means you can submit a complete package to your lender and the lender is required to pause foreclosure activities.

Key Points Homeowners Should Know:

- Submit a complete application — Incomplete documents may void protection

- Include proof of hardship — Job loss, illness, or other qualifying circumstances

- Lenders must acknowledge — Your application and cannot proceed with foreclosure

- Timing is critical — Acting early maximizes leverage and preserves equity

We guide homeowners in preparing a complete application and provide written instructions so the lender cannot reject due to technicalities.

Learn About No Dual Tracking

Get Your Free Written Guidance

Fill out the form below to receive personalized guidance on your options. All consultations are confidential.

Request Your Free Consultation

Share your situation and I'll provide clear, actionable guidance.

Or call Cliff directly:

619-601-4299